Bitcoin and cryptography prices have changed savagely during the last week after a sale of $ 300 billion, fears of a cryptography accident.

Register now for Cryptocurrency– a free newsletter for the cryptocurical

The price of Bitcoin has lost almost 10% since it reached a summit of $ 123,000 per Bitcoin, analysts speculating on a Bitcoin game changer could have already performed quietly.

Now, while fears are swirling around the future of the US dollar, the Wall Street Blackrock giant could be ready to prolong his advanced Bitcoin (ETF) fundraising on his rivals.

Register now for free Cryptocurrency–A five-minute daily newsletter for merchants, investors and cryptocurrency will update you and keep you in advance on Bitcoin and the Bull Run Crypto-Marché

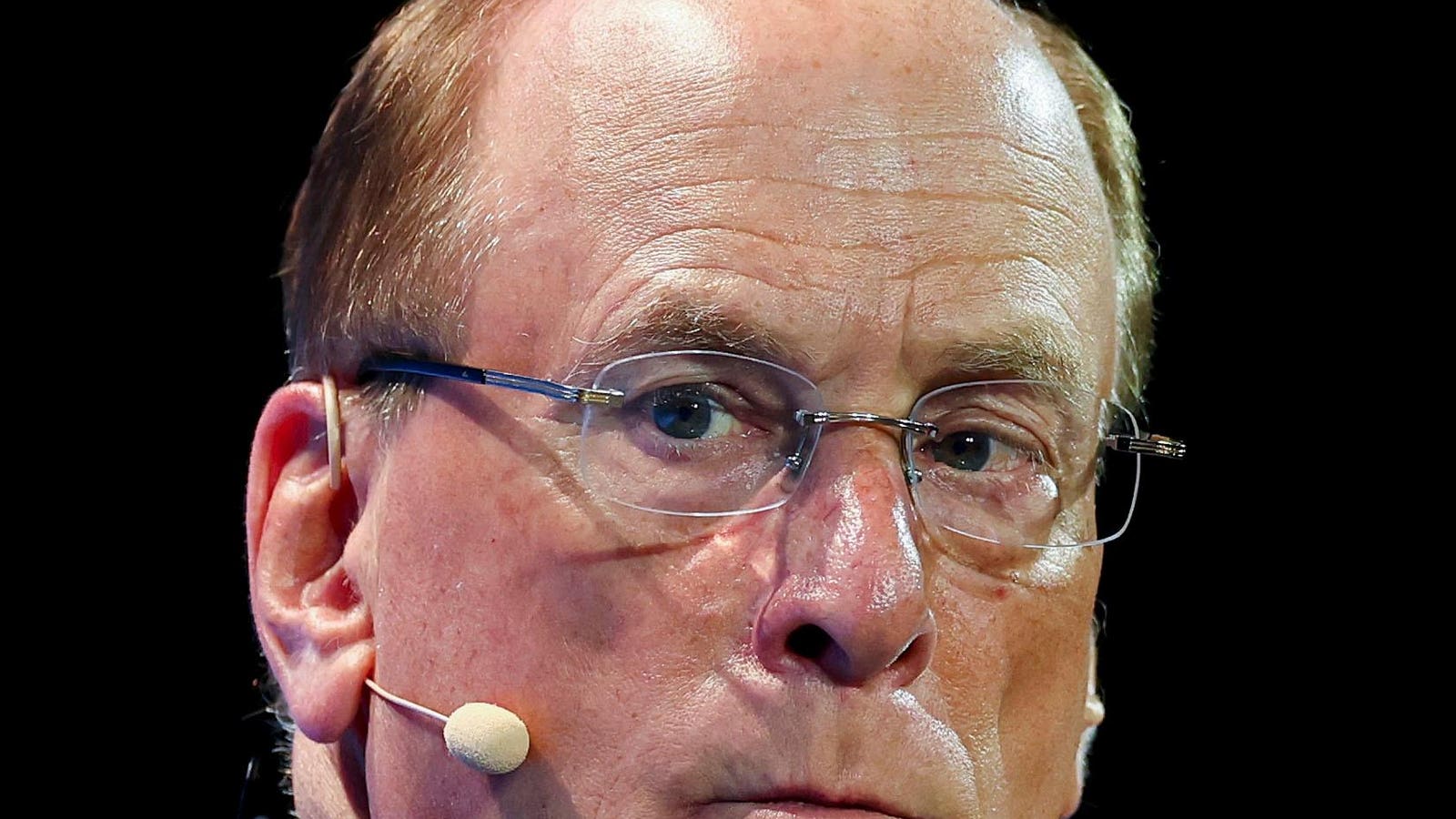

Blackrock CEO Larry Fink led a cryptographic revolution to Wall Street, sending the highly higher Bitcoin Prize.

© 2025 Bloomberg Finance LP

Last week last week, the Securities and Exchange (SEC) commission authorized the use of creation and buy -in mechanisms in kind for the Bitcoin negotiated funds and in exchange for crypto (ETF).

The long -awaited decision is part of the overhaul of the dry of the preference of former president Gary Gensler for products negotiated in exchange for crypto to be in cash, which was perceived as an obstacle to efficiency for institutional market manufacturers.

“This is a new day at the dry, and a key priority of my presidency is to develop a regulatory framework adjusted for the markets of cryptographic assets,” said the president of the dry Paul Atkins said in a declaration.

“The biggest point to remember is symbolic. This means that there is a new sheriff in town, “said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, said The Nowswire Financial. “The dry of peopleler did not want it to happen. This is the first of what will be several stages towards a more pro-Crypto dry.”

Blackrock, the largest asset manager in the world who manages the dominant Bitcoin ETF spot with $ 85 billion in management assets, filed a request in January to allow transactions in kind. Others, including Fidelity, who manages the second largest Bitcoin fund with 23 billion dollars in assets under management, followed suit.

Blackrock, which manages around 10 billions of dollars in investors, directed the Wall Street campaign to put a long -awaited bitcoin spot on the market on the market in 2023, with a fleet of funds in January 2024 which now hold nearly 1.5 million bitcoin worth $ 170 billion.

Register now for Cryptocurrency– a free newsletter for the cryptocurical

The price of bitcoin made a higher robbery, first pushed by the embrace of Wall Street towards Bitcoin and Crypto, then the support of American President Donald Trump.

Digital forbes active ingredients

The BlackRock Fund alone holds 3.5% of the 21 million bitcoin that will ever exist, worth almost $ 85 billion at the cost of current bitcoin, which some have warned could give excessive control on the BlackRock network.

In addition to the authorization of ETF Crypto in kind, the SEC has also approved a nasdaq proposal aimed at increasing a position limit for the options on the Ibit of BlackRock to 250,000 contracts, against 25,000, which should “help bring institutions and be useful during volatility”, Balchunas poster to X.

While the Bitcoin Fund of Blackrock should benefit from the change, the second largest Bitcoin fund, managed by Fidelity, could see its market share shrinking, according to the world research manager of Nydig, Greg Cipolaro.

“The change is likely to expand the monstrous advance that Ibit already has on the other players, while he hinders the position (Fidelity) as the second option player,” wrote Cipolaro in a report.

“As volatility decreases (Bitcoin) becomes more investable for institutional portfolios looking for balanced exposure to risks. This dynamic could strengthen punctual demand. With the gold and cryptocurrency of the risk, Ray Face of Balloon, the feedback loop of the fall in volatility leading to an increase in the purchase of points could become a powerful driver.

Last week, the legendary billionaire Ray Dalio on markets when he recommended a Bitcoin or gold portfolio allowance, warning that the federal reserve was taken in the “destiny loop” of the debt and that the dollar has exceeded the “point of non-report”.